Discover the perfect way to attracting and retaining talented employees with the help of Edenred’s employee benefits platform

Working with Edenred’s simple yet effective solutions can help your company to enhance its value proposition, thanks to our range of employee experience platforms and rewards, that are easy to set up and maintain.

Attracting and retaining talented employees is easy with Edenred

When it comes to your business, your employees are your greatest asset, which is why attracting and retaining the best of the best is of the utmost importance.

Whether you have 1 employee or 100,000, here at Edenred, we provide ways to motivate employees and a range of solutions to help you build an attractive employee value proposition, which will enable you to recruit the best talent.

Allowing you to tap into what makes people tick, our solutions can help increase employee engagement and motivation to help improve performance and make employees stay longer... because they want to, not because they have to.

At Edenred, our solutions can help by:

Retaining and attracting talent with Edenred solutions

Where perks and benefits were once a nice touch to a business, now, they’re essential.

Tapping into what your employees and future employees could want, or need, is the best way to ensure the best talent is working for you.

Here’s what Edenred can provide you to help ensure you attract, retain and motivate the best talent:

Build an effective employee retention program

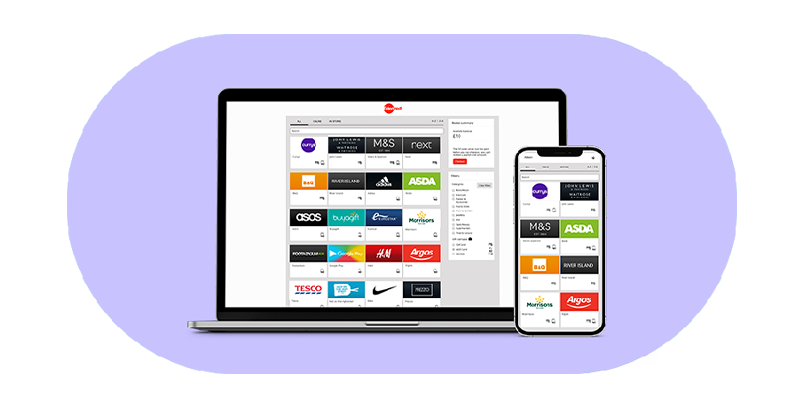

- Select eCodes is an excellent initiative to develop an employee retention scheme

- Reward your teams' hard work with employee vouchers that can be redeemed at over 100 retailers of their choosing

- Ideal for long-service rewards, end-of-year rewards, or general employee recognition

- Select eCodes can easily be sent instantly through our online portal

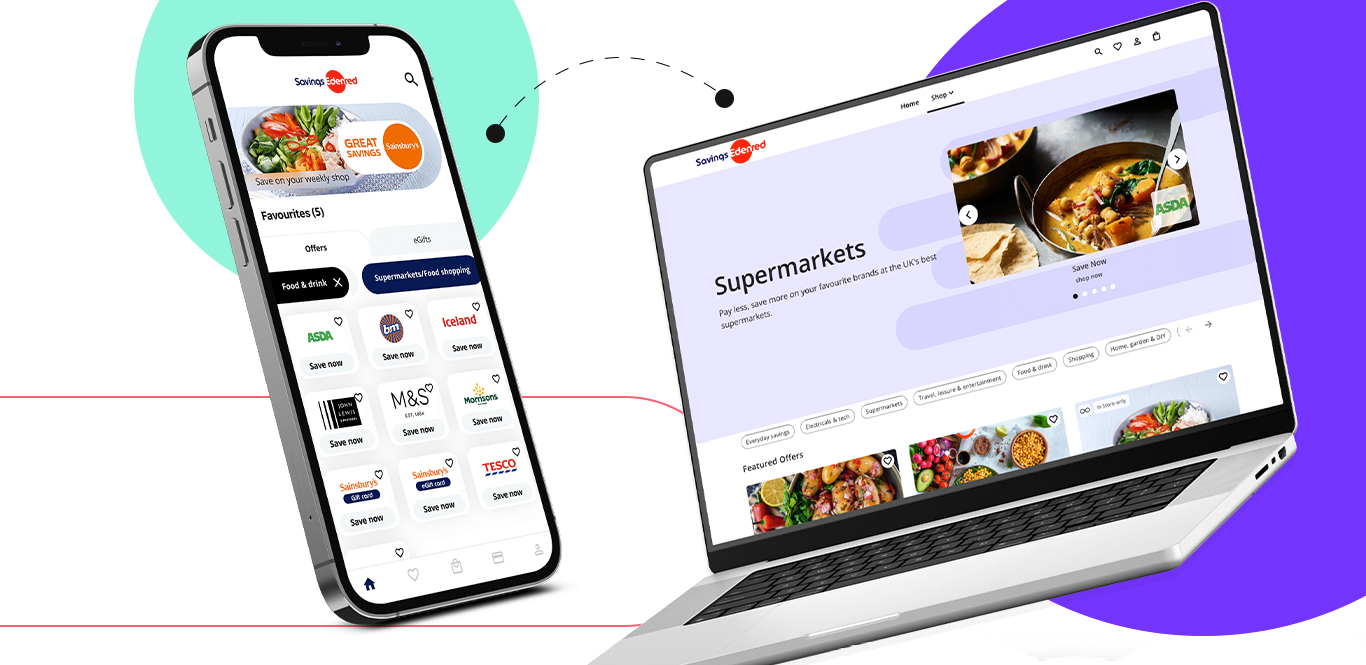

Employee Discounts

- Employee discounts are perfect for attracting and retaining talented employees

- Help your employees' wages stretch further with hundreds of discounts across a number of the UK’s top brands

- Your team will be able to save on everyday essentials like groceries, utilities to the latest tech, and more

- Make a bigger difference with our cashback module with over 4,000 participating retailers to choose from

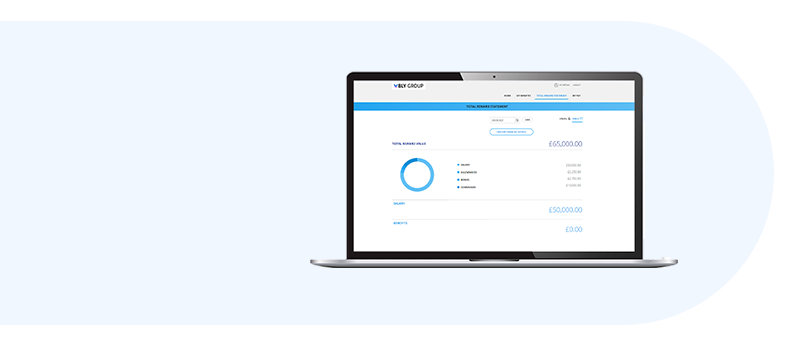

Total reward statements

- Ensure your employees understand the overall value of their combined salary and benefits

- Provide them with a complete view of their reward package, from salary, pensions, share schemes and wider benefit packages to incentive schemes, training and development

- Our total reward statements allow you to provide a clear view of how much the organisation values and appreciates each individual

Why Edenred’s solutions can help everyone attract, retain and reward the best talent

See it for yourself

Ready to find out more about our platforms? Get in touch today to book a no-obligations platform demo.

Products you may be interested in:

Check out our latest resources

Join our mailing list

Join our active community of over 11,000+ subscribers and gain access to the latest information to keep your employees engaged and motivated.